#Pandemic #economicchange #economy #reopen

Employment down, savings up, and an uncertain summer for the U.S. economy

June is here.

And as summer has arrives across the country, so too does something resembling a resumption of economic activity.

We’ve noted recently that economic data has stopped getting worse, building the case that the most severe impacts of the lockdown-related economic stoppage are behind us.

But this still leaves the economy a long way from healed.

As Bank of America outlined in a note last month, the current recovery is likely to play out in three phases: lockdown, transition, recovery. We are now in the transition phase. But what this phase might look like continues to be informed by some of the jarring data coming out of the economy’s March-April lockdown phase.

What we know is that tens of millions of workers have lost jobs. Last Thursday, initial jobless claims data brought total filings for unemployment insurance since this crisis began to north of 40 million.

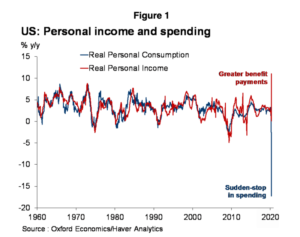

And on Friday, the April data on personal income, outlays, and savings served as another stunning entry in the history books. In response to mass unemployment, we know that consumers saved at a record rate, cut spending at a record rate, and saw incomes rise due to enhanced unemployment benefits passed through the CARES Act.

Taken together, this data really tells the simplest story of what happened in the U.S. economy during the most severe stage of this crisis — millions of people lost jobs and saved every penny they could as a result. How we go forward from here will be informed by fiscal policy, the spread of the virus, and how many workers are re-employed quickly.

“Consumer spending fell off a cliff in April, collapsing by 13.6% [month-over-month] while the annual momentum plunged to its weakest pace on record,” Lydia Boussour, senior U.S. economist at Oxford Economics, said in a note to clients. “Meanwhile greater benefit payments temporarily lifted income momentum to its strongest pace on record.”

The CARES Act boosted personal income in April while spending rose at a record pace amid massive job losses during the most severe stage of shelter-at-home policies hurting economic activity. (Source: Oxford Economics)

Boussour added that, “Amid extreme uncertainty, the savings rate spiked from 12.7% to 33.0% — the highest rate ever. This underscores how the global coronavirus recession is leading to more frugal consumer behavior which will dampen the recovery. This is particularly true as the boost from social benefits will gradually erode over time leaving households more financially constrained.”

And so it seems that Congress was able to keep U.S. consumers afloat while shelter-at-home policies and fears about the future kept most of those excess dollars coming into consumer stashed away. Savings during this initial phase of the pandemic and the recession could, it seems, help boost the economy into the second half of the year.

Michael Gapen at Barclays said in a note published Friday that, “under the assumption households have not spent the entirety of safety net payments already, the potential good news in the report on April personal income is that households have, on net, likely accumulated sizeable cash savings that could be spent in upcoming quarters should the U.S. economy successfully emerge from economic lockdowns.”

April’s personal income and spending data, then, serves as evidence of the consumer holding what amounts to economic dry powder as we emerge from shelter-at-home policies.

How quickly the labor market heals, however, is likely to be more important in shaping how eager consumers are to resume consumption in the months ahead.

This coming Friday, the May jobs report is expected to show the unemployment rate rose to 19.6% last month with another 8 million Americans losing their jobs, according to estimates from Bloomberg. In the view of some economists, the stubbornly high level of initial jobless claims shows that businesses which initially closed on a temporary basis early in this crisis are now closing permanently.

The fewer the better. And the clock is ticking.

Other posts

- Everything you need to know about second stimulus payment. IRS released the info and some people may get direct deposit payments before the new year.

- Taxpayers should check out these tips before choosing a tax preparer

- How the IRS prioritizes compliance work on high income non-filers through national and international efforts

- Taxpayers should know and understand their correct filing status

- Using the Tax Withholding Estimator will help taxpayers avoid surprises next year

- Relief for taxpayers affected by COVID-19 who take distributions or loans from retirement plans

- IRS warns against COVID-19 fraud; other financial schemes

- 159 million Economic Impact Payments processed; Low-income people and others who aren’t required to file tax returns can quickly register for payment with IRS Non-Filers tool

- IRS reminder: June 15 tax deadline postponed to July 15 for taxpayers who live and work abroad

- Exclusive First Look At The 954-Foot-Long Ship Touted To Be The ‘Ultimate Private Superyacht’